Office Property Valuation Template (DCF Valuation)

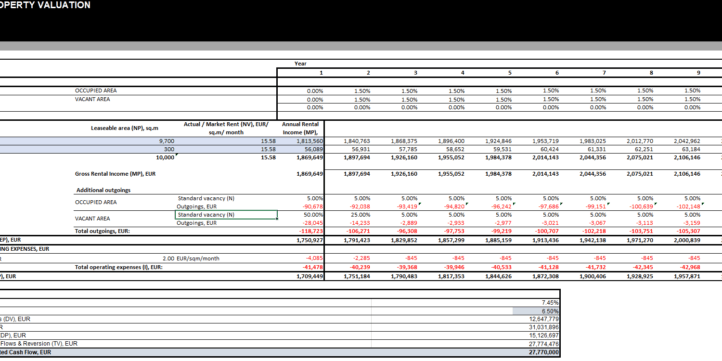

OFFICE PROPERTY VALUATION model allows you to determine the value of the property. The model generates discounted cash flow calculations to determine estimated property value. This model is created for office buildings, however, could be also used to determine the value of other cash-flow generating properties.

This financial model is an effective and easy-to-use tool for real estate valuation.

The Step-by-Step Process to use this financial model template:

Step 1: Set up the model Inputs: model currency, model start date (by default it is a 10-years financial projection). Also need to input the tenancy situation in the property for each tenant (leaseable area, parking permits that each tenant has, actual rent price per month, and other monthly income (it could be additional rental income from the logo on the building and so on).

Step 2: Make the calculations for WACC, which is used for DISCOUNT RATE to determine. All assumptions should be based on market practice (how much own funds are normally used in market transactions for such buildings to acquire, how much debt, and what is the price is for each). Normally, these assumptions are from the market transactions and can be found in real estate reviews.

Step 3: review calculations that are based on the calculation sheet. You have to make sure that long-term rental growth is correctly calculated for the rented area.

Step 4: Review the DCF VALUATION SHEET and make sure that there are no refs.

In case there are questions or queries regarding the model, I am able to provide assistance.

Important Notice: Yellow indicates inputs and assumptions that the user is able to change.

Similar Products

Other customers were also interested in...

Real Estate Financial Model Templates Package

This is a collection of ready-made Excel financial model templates for real estate businesses and it... Read more

Mixed-Use Real Estate Model: Leverage / JV Options

A general real estate model to plan all assumptions for up to 7 'uses' for a given property. Include... Read more

Office Building Development Financial Model (Const...

Financial model presenting a development scenario for an Office Building including construction, ope... Read more

Real Estate Acquisition Financial Model (Commercia...

Simple Real Estate Acquisition Financial Model suitable for Commercial, Industrial and Residential P... Read more

Office Building Acquisition Financial Model

Financial model presenting an investment scenario of an Office Building, from the acquisition of the... Read more

Commercial Real Estate – Lease or Sell Quart...

Commercial Real Estate - Lease or Sell Quarterly Excel Model with 3 Statements, Valuation, and Devel... Read more

Office Acquisition REFM Financial Model Excel Temp...

Try Office Acquisition REFM Financial Model. Enhance your pitch decks and impress potential investor... Read more

Real Estate Financial Model Bundle

This is a collection of financial model templates that provides the financial projections and valuat... Read more

Real Estate Development Financial Models Bundle

A collection of seven Real Estate Development Financial Models offered at a discounted price you can... Read more

Coworking Business Financial Projection 3 Statemen...

5-year 3-statement excel model for preparation of a financial projection for new or existing busines... Read more

You must log in to submit a review.