Monthly Dynamic 3 Statements & Valuation

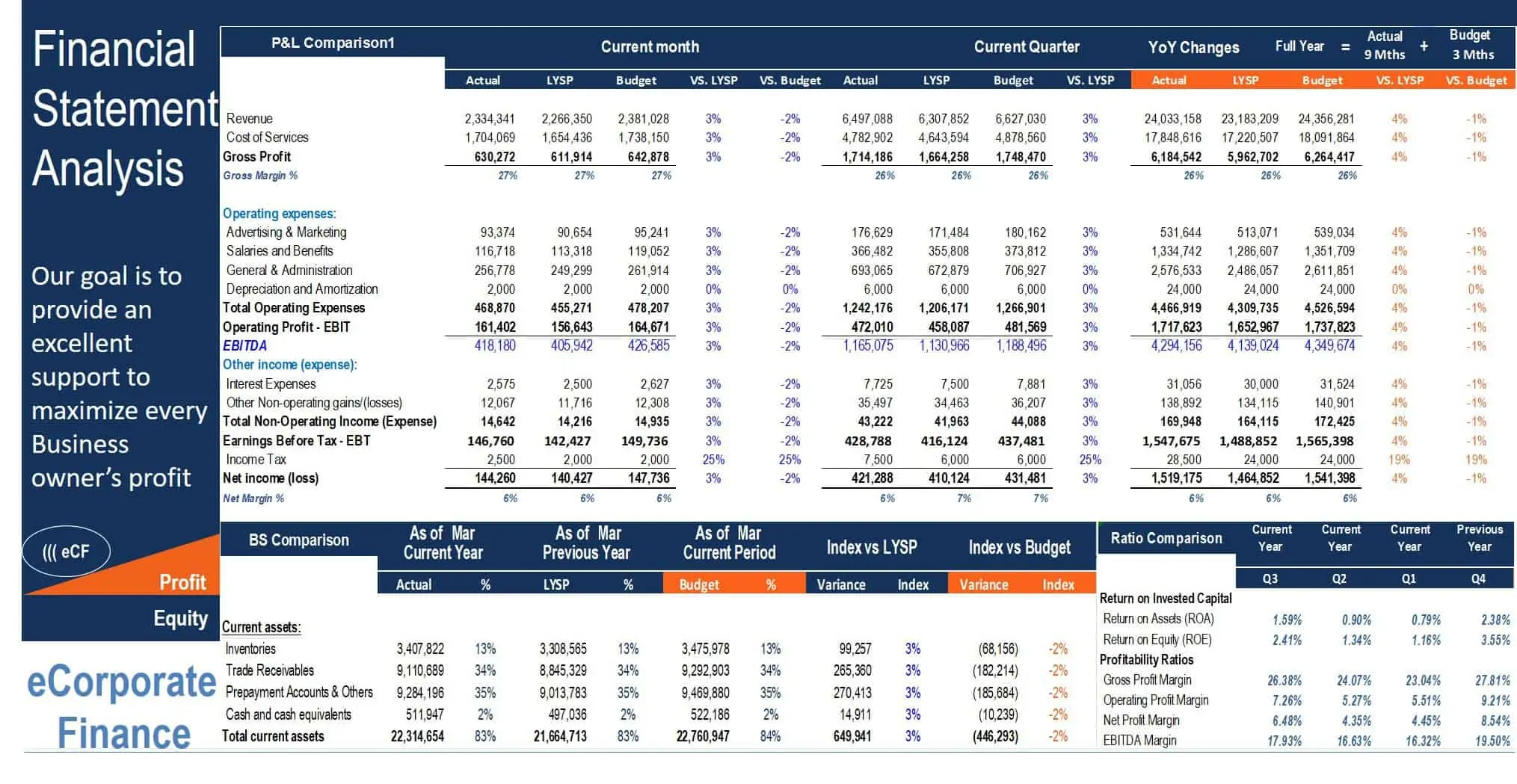

The template contains the cash flow statement, the income statement, the balance sheet statement as well as ratios, variance analysis, and valuation of the business. All the statements together produce an overall picture of the health of the business

General Overview

The template contains the cash flow statement, the income statement, the balance sheet statement as well as ratios, variance analysis, and valuation of the business. All the statements together produce an overall picture of the health of the business.

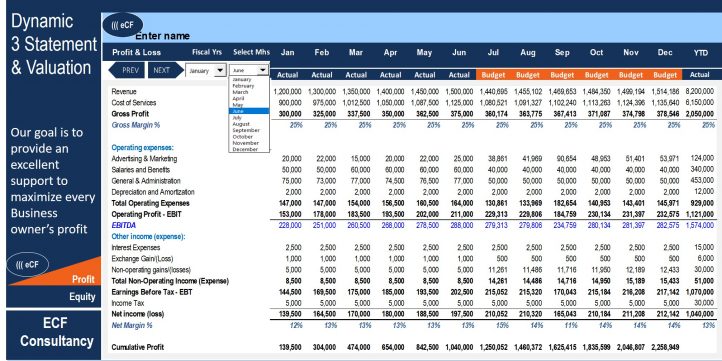

The template showing statements for 12 months, actual year to date by selecting on monthly basis the current month from the selection box in the “Profit & Loss” sheet under column C, and instantly the model will show the budget for the remaining months of the year, also the user can change the fiscal year by choosing the startup month from the selection box in “Profit & Loss” sheet under column B.

The model follows the best practice financial modeling principles and includes instructions and explanations.

So, a quick overview of the model, in the contents sheet you can see the structure of the model, and by clicking on any of the headlines will automatically be redirected to the relevant sheet.

Inputs in the green tabs

Update the general info in the “Front Page” sheet

Enter the budget income statement and balance sheet for 12 months in the “Budget” sheet, fill only the green cells

Choose the current month from the selection box in the “Profit & Loss” sheet under column C

Enter on a monthly basis the actual income statement and balance sheet in the “PY & YTD” sheet, fill only the green cells

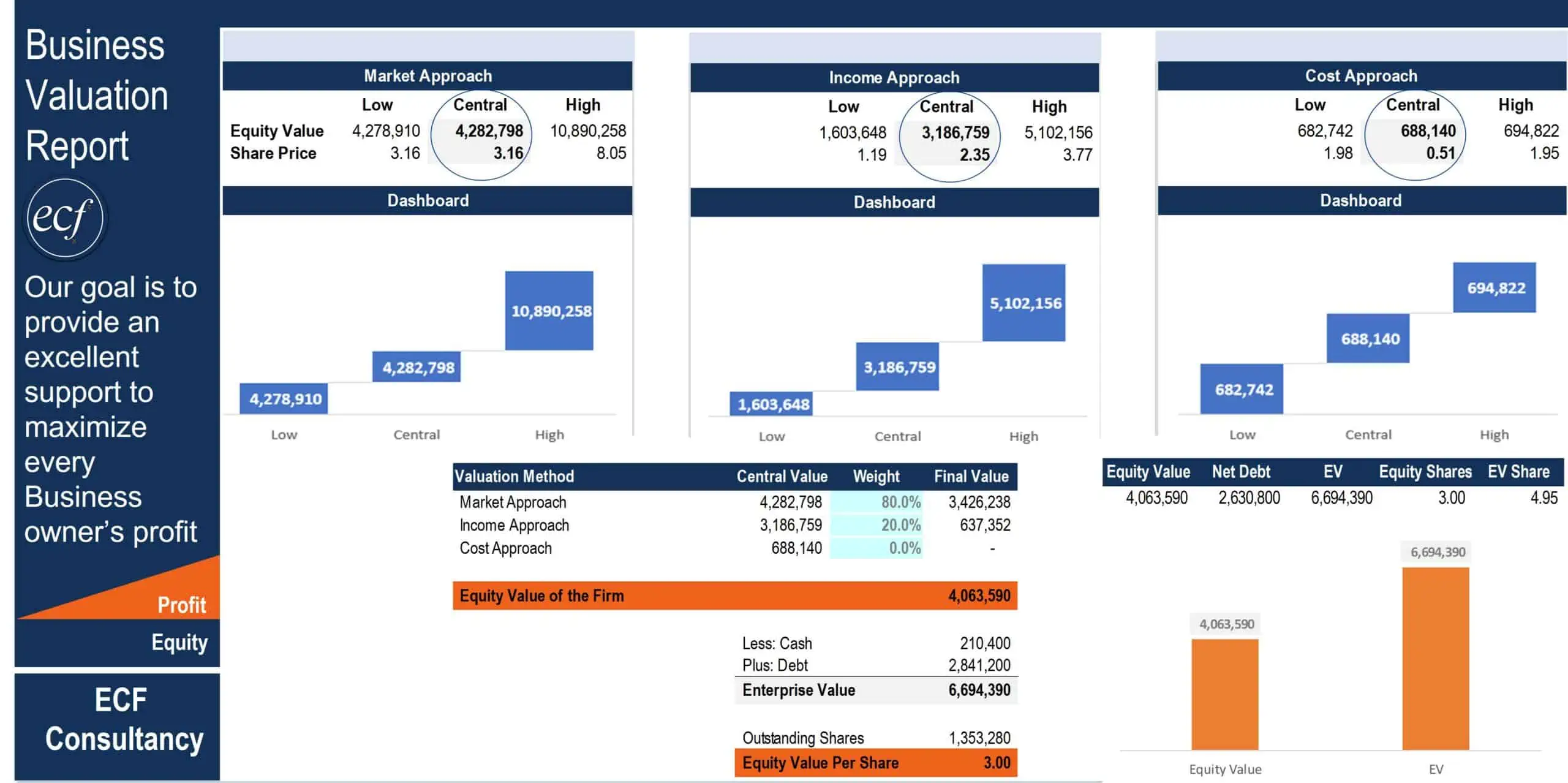

Fill the green cells only in the “Valuation” sheet, for valuation and WACC calculator purpose

Outputs

The inputs in the green cells will dynamically flow into the following below:

Profit and loss statement by month including 3 major components, gross profit, EBITDA, and net profit

Balance sheet by month including total assets, total liability, and owners’ equity

Cash flow by month with 3 outputs such as operating cash flow, investing cash flow, and financing cash flow

P&L comparison with outputs such as actual vs budget for the current month, actual vs budget year to date, and actual vs budget for the full year

Ratios with 6 main components, such as return on investment, profitability ratio, liquidity ratio, solvency ratio, activity ratio, and leverage ratio,

WACC, NPV, Discounting cash flow for 5 years forecasting

Intrinsic value, Market value, and sensitive analysis

Dashboard summary

Conclusion and customization

Highly versatile, very sophisticated financial template, and user-friendly.

If you have any inquiries, any modifications, or customization requests of the model for your business, please reach us through: [email protected]

Similar Products

Other customers were also interested in...

Corporate Finance Toolkit – 24 Financial Mod...

They are essential models to increase your productivity, plan your future with budgeting and forecas... Read more

Financial Modeling Analysis

The main purpose of the model is to allows user to easily compare the financial performance result f... Read more

Comprehensive Business Valuation Model with Free P...

The report is detailed and easy template which allow the user to determine and monitor the value of ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Franchisor Licensing: Financial Model with Cap Tab...

Build up to a 10 year financial forecast with assumptions directly related to the startup and operat... Read more

3 Statement Financial Modeling with DCF & Rel...

Financial Modeling Tutorial guides user via step by step approach on how to build financial models w... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

You must log in to submit a review.