In-Home Daycare Financial Model Excel Template

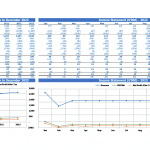

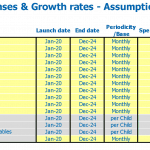

Purchase In-Home Daycare Financial Plan. Spend less time on Cash Flow forecasting and more time on your products. Highly versatile and user-friendly In-Home Daycare Budget Spreadsheet for the preparation of a Pro Forma Profit And Loss Statement, Cash Flow Statement Proforma, and Balance Sheet with a monthly and annual timeline. Works for a startup or existing in-home daycare business Use In-Home Daycare P&L Projection before acquiring in-home daycare business, and get funded by banks or investors. Unlocked – edit all – last updated in Sep 2020. All in one package of print-ready reports, including a in-home daycare pro forma profit and loss statement, pro forma cash flow projection, a balance sheet, and a complete set of financial metrics.

NOTE: Single-User pertains to a limited Single User License where the template can only be used by one single user; while Multi-User is a license for users sharing the template with up to 20 members. Please refer to Terms of Use and License and Permitted Use for clarification.

IN-HOME DAYCARE FINANCIAL MODEL KEY FEATURES

Video tutorial:

It is part of the reports set you need.

It doesn’t matter you are worried about cash or not, setting up, and managing a In-Home Daycare Financial Model Excel Spreadsheet should be a cornerstone of your reporting set. It’s the main report of your business that must have in place to grow sustainably. Before you rush into rent more office space or making a new hire, you should always run a Projected Cash Flow Statement scenario. You can model how that action would impact your cash balance in the nearest future. Knowing whether or not plans are possible is crucial to minimizing risk.

Currency for inputs and denomination

In Three Statement Financial Model Template define any currency code or symbol and preferred denomination (e.g. 000s) to reflect your preferences.

Identify cash gaps and surpluses before they happen.

Forecasting your future cash balance helps you see well in advance when you may have a cash deficit that could hurt your business. Pro Forma Cash Flow Projection will give you enough time to take action to prevent a crisis. It will enable you to access better loan rates or speed up incoming payment to bridge the gap. On the other side, if you know ahead of time that the large lump of cash will lay in your bank account within the next three months. In this case, you might need to explore options to reinvest it in your business to drive growth.

Avoid Cash Flow Shortfalls

Unexpected Cash Flow Projection shortfalls can cause significant damage to your business, and it may take months to recover. Negative Cash Flow can appear if you don’t continuously track the incoming cash and outgoing of your business. Fortunately, you can solve Cash Flow Pro Forma shortfalls with a bit of effort. Forecasting your Startup Cash Flow Projection will help you identify — and plan for — market fluctuations, sales seasonality, and other cases that can lead to unpredictable Cash Flow Statement By Month. Cash Flow Pro Forma can even help you visualize Cash Flow Statement trends with the help of automatically generated charts and graphs.

Gaining trust from stakeholders

Investors and financing providers tend to think in terms of the big picture. They want the c-level of the companies they invest in to do the same to ensure they maintain a clear idea of the future. Providing stakeholders with a monthly statement of cash flows will demonstrate a level of awareness that leads to confidence and trust and will make it easier to raise more investment.

All necessary reports

When creating a In-Home Daycare Financial Projection Template, you will not need to independently prepare financial reports and study the requirements for them. Our Excel template contains all the necessary reports and calculations that correspond with the lenders demand.

REPORTS and INPUTS

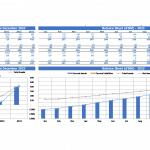

Burn and Runway

The cash burn rate shows the difference between the cash inflows and cash outflows of the company. It is essential to monitor this metric because it shows how long the company will last with its current funding level. Business owners can also see a clear picture of how various business strategies change the cash burn rate.

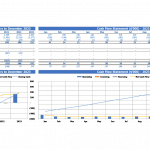

Performance KPIs

Payback period. The cost of acquiring new customers should be compared to the profits that these customers generate. When these two numbers are divided, the result is called a payback period.

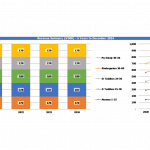

Financial KPIs

In the Financial Projection Template you can visually track key financial indicators over the five years period as well as 24 months period.

– EBITDA/EBIT shows your company’s operational performance

– CASH FLOWS shows your company’s inflows and outflows

– CASH BALANCE this is the forecast of cash in hand you will have.

Operational KPIs

Financial graphs and charts in this In-Home Daycare Excel Financial Model help the stakeholders visually track liquidity, budgets, expenses, cash flow, and many other company financial metrics. These graphs will also help a company’s management avoid problems by reflecting its financial data in real-time, with a comprehensive financial information overview.

These operational performance graphs will help the business owners and financial managers ensure the best possible performance and financial health of their company because regular financial analytics procedures and the highest quality of financial data are the company’s top priorities.

Our financial graphs will also help the company’s financial specialists raise financial issues at the general meetings and deliver understandable financial information to other departments and external stakeholders.

Valuation

Our In-Home Daycare Excel Pro Forma Template has two integrated valuation methods. It has a discounted cash flow (DCF) and the weighted average cost of capital (WACC) calculations to show a company’s forecasted financial performance.

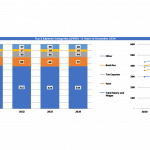

Sources and Uses

The statement of the sources and uses of cash gives users a summary of where capital will come from (the “”Sources””) and how this capital will be spent (the “”Uses””). The statement is structured in the way that the total amounts of the sources and uses accounts should equal each other.

The sources and uses statement is critical for the situations when the company considers recapitalization, restructuring, or mergers & acquisitions (M&A) procedures.

CAPEX

This In-Home Daycare Financial Projection Model Template consist a CapEx calculation with pre-built formulas helps users calculate the volume of capital expenditures using numbers in the profit and loss pro forma and balance sheet.

File types:

Excel – Single-User: .xlsx

Excel – Multi-User: .xlsx

Free Demo – .xlsx

Similar Products

Other customers were also interested in...

Childcare Center Financial Plan

The Childcare Center business model template aims to forecast the financial feasibility and profitab... Read more

Pre-School Care Financial Model Excel Template

Get the Best Pre-School Care Financial Projection Template. Creates a financial summary formatted fo... Read more

Child Care Financial Model Excel Template

Try Child Care Pro Forma Projection. Simple-to-use yet very sophisticated planning tool. Get reliabl... Read more

Family Service Financial Model Excel Template

Get Your Family Service Financial Model. Create fully-integrated financial projection for 5 years. W... Read more

Infant Care Financial Model Excel Template

Impress bankers and investors with a proven, solid Infant Care Financial Projection Template. Genera... Read more

Babysitting Financial Model Excel Template

Discover Babysitting Financial Projection Template. Use this Excel to plan effectively, manage Cash ... Read more

Baby Minding Financial Model Excel Template

Get Baby Minding Financial Model Template. Simple-to-use yet very sophisticated planning tool. Get r... Read more

Online Tutoring Services Financial Model (10+ Yrs ...

The Online Tutoring Services Financial Model is a comprehensive tool designed to analyze the financi... Read more

Start Up Nursery School Financial Model

Start Up Nursery School Financial Model presents the case of an investment in a nursery school and i... Read more

Driving School – 5 Year Financial Model

Financial Model providing an advanced 5-year financial plan for a startup or operating Driving Schoo... Read more

You must log in to submit a review.