Financial Ratios in Excel

Financial statement analysis is useful to anticipate future conditions and, most important, as a starting point for developing strategies that influence a company’s future course of business. An important step toward achieving these goals is to analyze the firm’s financial ratios. Ratios are designed to highlight relationships between the financial statement accounts. These relationships begin to reveal how well a company is doing in its primary goal of creating value for its shareholders. There are two ratio analysis techniques that provide additional insight into a company. The first technique is to compare the ratios of one company with other similar companies within the same industry. The second technique is to observe trends of the ratios over a period. These trends give clues about a company’s performance. The most common financial ratios can be grouped into five general categories: Liquidity Ratios Asset Management Ratios Debt Management Ratios Profitability Ratios Market Value Ratios

| All Industries, Financial Model, General Excel Financial Models |

| Excel, Financial Ratios |

Financial statement analysis is useful to anticipate future conditions and, most importantly, as a starting point for developing strategies that influence a company’s future course of business.

An important step toward achieving these goals is to analyze the firm’s financial ratios. Ratios are designed to highlight relationships between the financial statement accounts. These relationships begin to reveal how well a company is doing in its primary goal of creating value for its shareholders.

There are two ratio analysis techniques that provide additional insight into a company. The first technique is to compare the ratios of one company with other similar companies within the same industry. The second technique is to observe trends of the ratios over a period. These trends give clues about a company’s performance.

The most common financial ratios can be grouped into five general categories:

Liquidity Ratios

Asset Management Ratios

Debt Management Ratios

Profitability Ratios

Market Value Ratios

Liquidity Ratios

Liquidity Ratios address one of the first concerns of a firm: Will the company be able to meet its obligations. These ratios attempt to measure the extent to which the short-term creditors of the firm are covered by assets that are expected to be converted to cash in roughly the same period.

Liquidity Ratios include:

Current Ratio: The Current Ratio is calculated by dividing CURRENT ASSETS by CURRENT LIABILITIES. The Current Ratio means that, if necessary, the company could use its current assets to pay off its current liabilities. If a company is experiencing financial difficulty; it may begin to pay its bills more slowly. If CURRENT LIABILITIES are rising more quickly than CURRENT ASSETS, the Current Ratio will fall. This could indicate trouble in the company.

Quick (Acid-Test) Ratio: The Quick (Acid-Test) Ratio is computed by subtracting INVENTORIES from CURRENT ASSETS, then dividing the remainder by CURRENT LIABILITIES. Inventories usually are the least liquid of the current assets. They are the most difficult to convert to cash and most likely to incur losses during a liquidation. The Quick Ratio gives an indication of the firm’s ability to meet short-term obligations without relying on the sale of inventories.

Asset Management Ratios

These ratios attempt to measure how effectively the company is managing its assets. They are designed to tell the analyst if the amounts of each type of asset reported on the Balance Sheet are reasonable, given the current and anticipated operating levels of the firm.

Asset Management Ratios include:

Inventory Turnover Ratio: The Inventory Turnover (Inventory Utilization) Ratio is calculated by dividing the Net SALES of the firm by its INVENTORIES. Obsolete, unnecessary, or excess products held in inventories cause the Asset Turnover Ratio to fall, which may indicate a need for management action.

The first concern is that sales are stated at market prices, whereas inventories are usually carried at cost. In an environment with rapidly changing prices, the ratio would overstate the inventory turnover rate. When market prices are volatile, a more accurate calculation may be made using the Cost of Goods Sold in the numerator. The other weakness is that sales occur over the entire year, whereas the inventory is valued at a point of time. A business with highly seasonal trends may calculate the ratio using an average inventory figure.

Average Collection Period: The Average Collection Period (ACP) is often used to appraise ACCOUNTS RECEIVABLE. It is computed by dividing ACCOUNTS RECEIVABLE by the average daily sales. The Average Collection Period represents the number of days the company must wait after a sale is made before receiving cash.

Fixed Assets Turnover Ratio: To measure the utilization of the firm’s plant and equipment, the Fixed Assets Turnover (Fixed Asset Utilization) Ratio can be used. It is the firm’s SALES divided by its FIXED ASSETS. Unnecessary or underutilized fixed assets that do not increase sales cause this ratio to become lower. Once again, consider that in a period of rapidly changing prices, the value of fixed assets on the Balance Sheet may be seriously understated. This causes a firm with older equipment to report a higher turnover than a firm with more recently purchased plants and equipment.

Total Assets Turnover Ratio: The Total Assets Turnover Ratio measures the utilization of the company’s assets. To compute the Total Assets Turnover Ratio, divide SALES by TOTAL ASSETS. The Total Assets Turnover Ratio indicates how many times the value of all ASSETS is being generated in SALES. The same concerns about understated assets also are applicable to the Total Assets Turnover Ratio.

Debt Management Ratios

Analysts have developed ratios to determine the extent of the use of borrowed funds to finance assets and to determine how many times the income generated by those assets can be

Similar Products

Other customers were also interested in...

Operating Company Financial Model

Operating Company Model consists of an Excel model which allows the user to generate forecast financ... Read more

Capital Budgeting Model Excel Template

Capital Budgeting consists of a process that companies use for decision making on investment project... Read more

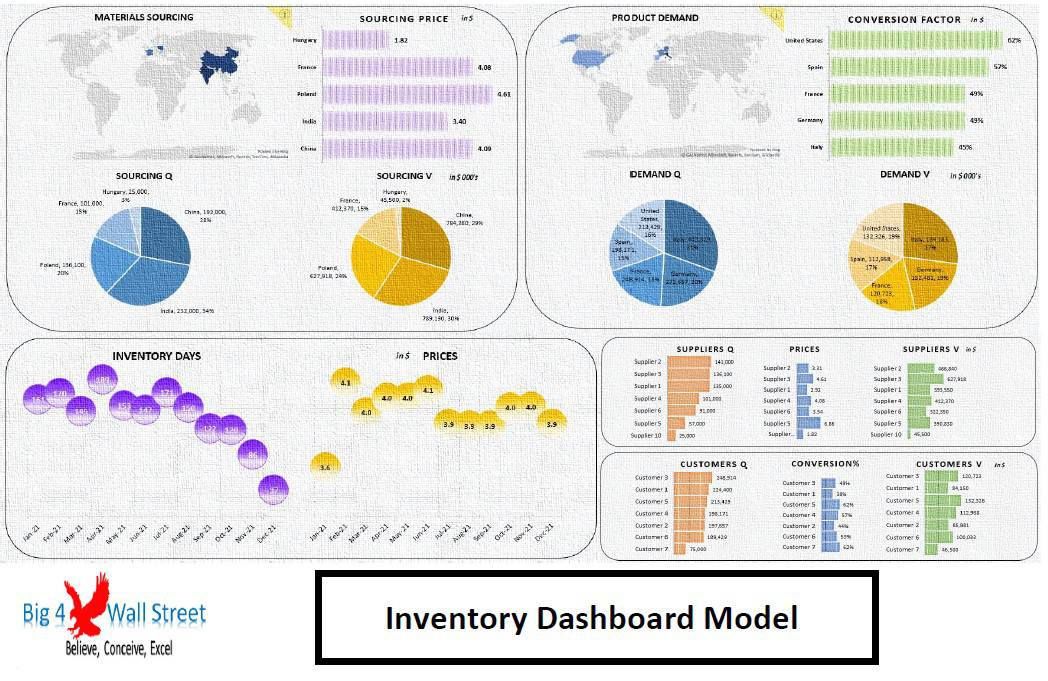

Inventory Dashboard Model Template

!! Kindly use the latest Microsoft Excel Version before purchasing the model, otherwise, the dynamic... Read more

Mergers and Acquisition (M&A) Financial Model

Merger and Acquisition Model template consists of an excel model which assists the user to assess th... Read more

Leveraged Buyout (LBO) Model

Leveraged Buy Out (LBO) Model presents the business case of the purchase of a company by using a hig... Read more

Sales Commissions Dashboard

This model will allow you to plan your commission structure and monitor the performance of your sale... Read more

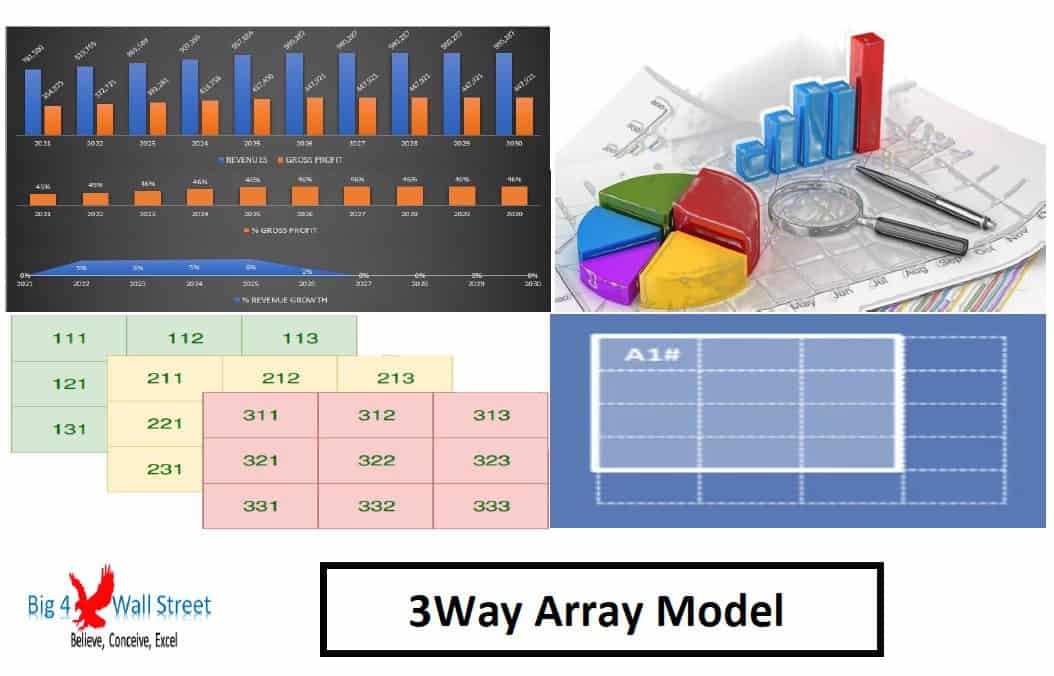

Dynamic Arrays Financial Model

Dynamic Arrays Financial Model generates the three financial statements (profit & loss, balance ... Read more

Options and Real Options Model Template

Options and Real Options model consists of an Excel model which presents a valuation framework calcu... Read more

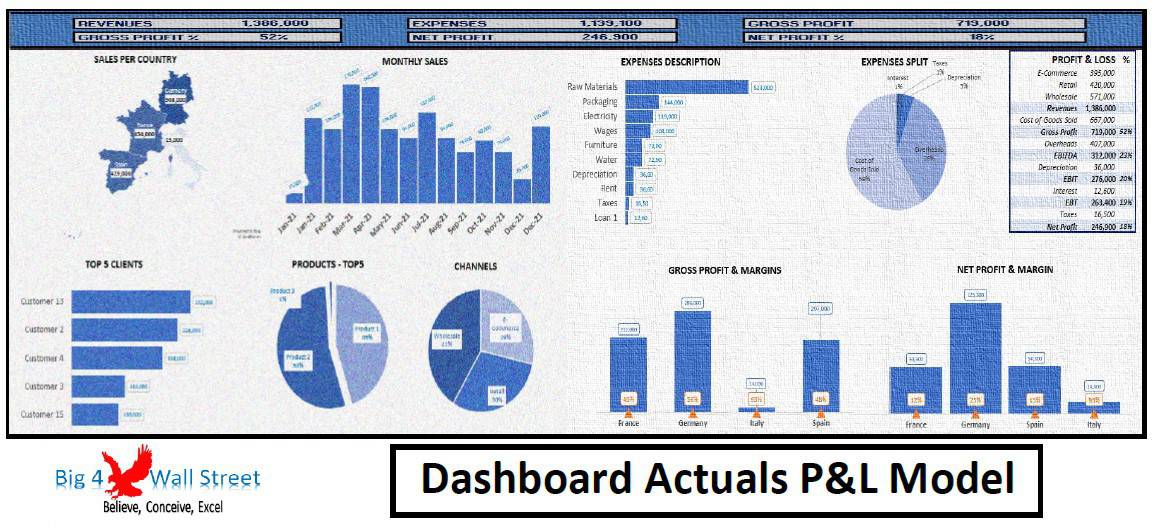

Dashboard Actuals PnL Model

!! Kindly use the latest Microsoft Excel Version before purchasing the model, otherwise, the dynamic... Read more

Cash Budget Model

Cash Budget Excel Model generates a simple cash forecast based on a series of assumptions, and compa... Read more

You must log in to submit a review.