Discounted Cash Flows Valuation Model

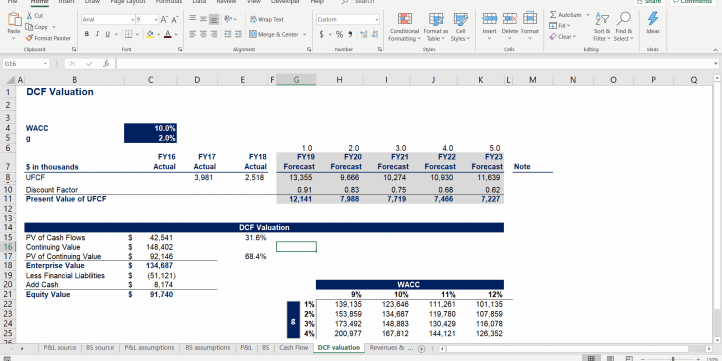

The Discounted Cash Flow (DCF) Valuation is one method to estimate current value of a business.

The Discounted Cash Flow (DCF) Valuation is one method to estimate the current value of a business. Included in the template you will find:

• The Income Statement, Balance Sheet and Cash Flow Statement

• An Assumptions Section with 3 scenarios for the financial forecast

• Discounted Cash Flows projection with Sensitivity Analysis

• Charts and Graphs for various key measurements

All historical data from previous income statements and balance sheets can be entered into the P&L and BS source tabs to dynamically flow into their respective tabs. This will set up the actuals for the P&L and Balance Sheet.

Using the P&L and BS Assumptions tabs, the projections can be set for the business. Assumptions can be set for each of the 3 scenarios under each forecast period. The desired case can be selected from the drop-down box in cell C5 of the P&L Assumptions. On the DCF Valuation tab, the WACC and growth rate (g) can be entered in cells C4 and C5 to adjust the valuation for the specific industry. All charts are formulas tied to their respective sections, except for the DCF Results chart. This chart will need to be updated with the Enterprise Values for each scenario entered in cells C5. H5 and M5. The text boxes in the center of each donut graph will need to be manually entered as well with the Enterprise Values.

All cells in black font are input cells where custom information can be entered. All cells in blue font are formulas set to streamline the model.

Similar Products

Other customers were also interested in...

Mergers & Acquisitions (M&A) Model

The Mergers & Acquisition (M&A) Model provides a projection for a company looking to potentially... Read more

Leveraged Buyout (LBO) Model Template

The Leveraged Buyout (LBO) Model provides a business valuation of a target company for investment. T... Read more

Private Equity Acquisition Model

The Private Equity Acquisition Model provides a business valuation of a target company for investmen... Read more

Basic Founder’s Package – Financial Foreca...

This is a bundle of financial model templates best suited for financial forecasting and for startups... Read more

Basic Founder’s Package – Business Valuati...

To help you get a discount out of buying multiple financial model templates for business valuation, ... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

All My Financial Models, Spreadsheets, Templates, ...

Lifetime access to all future templates as well! Here is a set of spreadsheets that have some of the... Read more

Advanced Financial Model with DCF & Valuation

General Overview Advanced Financial Model suitable for any type of business/industry and fully cu... Read more

Startup Company Financial Model – 5 Year Fin...

Highly-sophisticated and user-friendly financial model for Startup Companies providing a 5-Year adva... Read more

Due Diligence P&L – Exhaustive Revenue a...

Model for in depth understanding of high level profit and loss and revenue analysis. Big-4 like chec... Read more

You must log in to submit a review.