Compare 2 Loans with Varying Compounding Periods

Compare two loans with varying criteria and compounding periods.

| Financial Model, Financial Services, Loans & Lending Businesses |

| Debt Amortization, Debt Schedule, Debt Security, Excel, Financial Debt |

You can do a lot with this financial model. It compares two separate loans with the option of having different compounding periods with the click of a drop-down menu, different interest rates, a given starting day that default interest begins to accrue, and more.

Compounding Periods: Simple, Daily, Monthly, Quarterly, Yearly

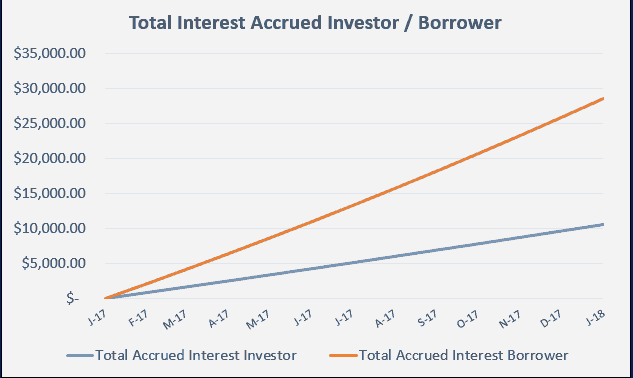

The idea here is to clearly show the debt of a loan and the impact to each entity. Visuals have been included to show principal balances and total interest accrued over time.

You can go out to a max of 5 years, but simply dragging the bottom row formulas lower extends the amortization schedules.

User also has the ability to enter a date and see the current principal + interest balance.

User can enter a given payment or increase in the loan at any date and the principal / interest basis will adjust accordingly.

The primary use of of this tool is going to be to compare facilities where regular payments are not made, but rather interest accrues and payments may be made throughout the life of the facility.

Similar Products

Other customers were also interested in...

Lending Platform Financial Model (LaaS)

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (... Read more

Flat Fee Lending Business: Operating Model

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for orig... Read more

Lending Model Startup Forecast: 10-Year Scaling &#...

This is a full 10-year startup lending business financial model, including a 3-statement model. Accu... Read more

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Collateralized Mortgage Obligations Model

Collateralized Mortgage Obligations Model presents a simple model where mortgage backed securities a... Read more

Lending Business Financial Projection 3 Statement ...

3 Statement 5 year rolling financial projection Excel model for existing/startup business borrowing ... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

You must log in to submit a review.