ATM Machine Business – 10 Year Startup Financial Model

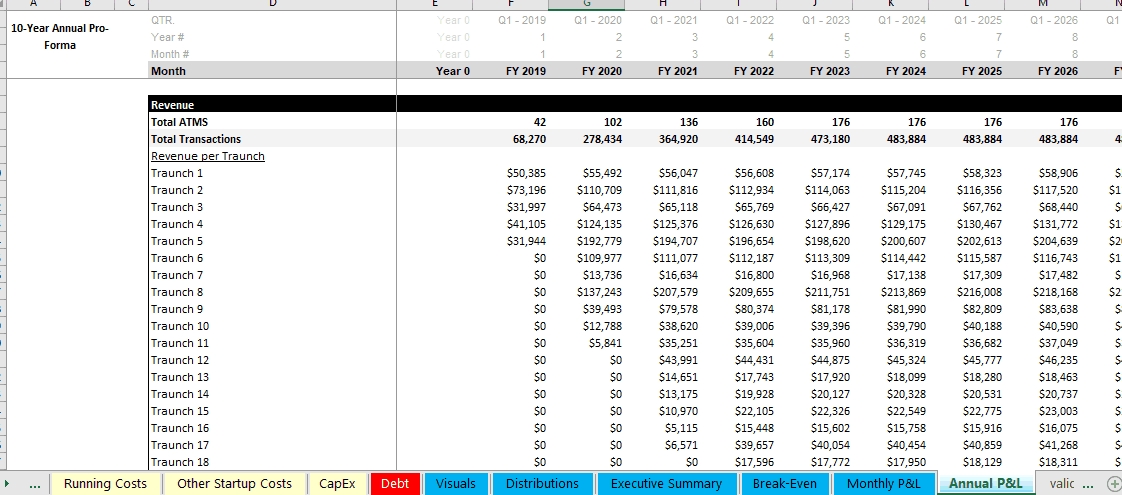

Specific revenue and expense logic for modeling the build-up of an ATM machine business over 10 years. Includes financial statements and detailed cap table.

Video Instructions:

Recent Updates: Added monthly and annual financial statements (IS, BS, CF) and a detailed capitalization table as well as a dynamic capital expenditure schedule for the ATMs with connected depreciation logic.

The dynamic nature of this model is that you can plan for over 20 tranches of purchases of ATM machines in your forecasting scale-up of this type of business. Each traunch allows the user to enter deal-specific variables such as the amount of ATMs purchased, the cost per ATM, the average transactions per day, the fee per transaction, and the merchant fee.

There is also dynamic depreciation based on when machines are purchased and the variable input for useful life. This is used in the tax calculation in order to get a more accurate free cash flow figure per month and year.

There are assumptions for the length you plan to run the business for (up to 10 years) as well as the exit month if applicable, and the exit valuation (based on a revenue multiple in the exit month).

You have assumptions for debt and equity and the equity is broken down into investor / owner equity if applicable.

The cash requirement populates based on the expected monthly cash flows and looks at the minimum cash position after debt / startup costs / ATM purchases over time / revenues per month in order to default into the total upfront investment needed in order to stay cash positive.

Summaries for monthly/annual P&L and cash flow detail are available as well as a distribution summary that shows cash flow to owner and investor per %’s defined for the investor/owner. An equity multiple, IRR, ROI, total cash returned, and DCF analysis are also shown for each pool as well as at the project level.

A high-level executive summary is used to convert the annual P&L / cash flow detail into a standard revenue/COGS/expenses/EBITDA format as well as cash flow items so you can see the free cash flow per year.

The dynamic nature of this model is really useful for strategic planning and the timing assumptions for everything that affects free cash flow and equity returns.

Similar Products

Other customers were also interested in...

Lending Platform Financial Model (LaaS)

Includes all the assumptions you need to project the gross revenues and profits of a LaaS platform (... Read more

Lending Model Startup Forecast: 10-Year Scaling &#...

This is a full 10-year startup lending business financial model, including a 3-statement model. Accu... Read more

Flat Fee Lending Business: Operating Model

10-year financial model directly built for a flat fee / fixed fee lender. Includes leverage for orig... Read more

Real Estate Brokerage Economic Analysis

Create up to a 10 year financial forecast for a real estate brokerage operator. Includes three way m... Read more

SaaS Financial Model Bundle

This is a bundle of Financial Model Templates for SaaS businesses and their related sectors such as ... Read more

Pawn Shop / Broker 5 Year Financial Model

Video Tutorial: https://www.youtube.com/watch?v=3mZFMB4z0Qc The model have revenue a... Read more

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Loan Tape Analysis / KPI Dashboard

A framework that makes it easy to drop in your loan data and automatically generate analytical insig... Read more

Investment Fund Preferred Return Tracker: Up to 30...

Track preferred returns for investors in a fund with this template. Premium joint venture tracking t... Read more

Hedge Fund Soft Fee Model

A model that calculates hedge fund fees based on performance of the account over time. Includes a hi... Read more

You must log in to submit a review.