Alternative Investment Company Valuation Template

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset Management, and Advisory Business Lines.

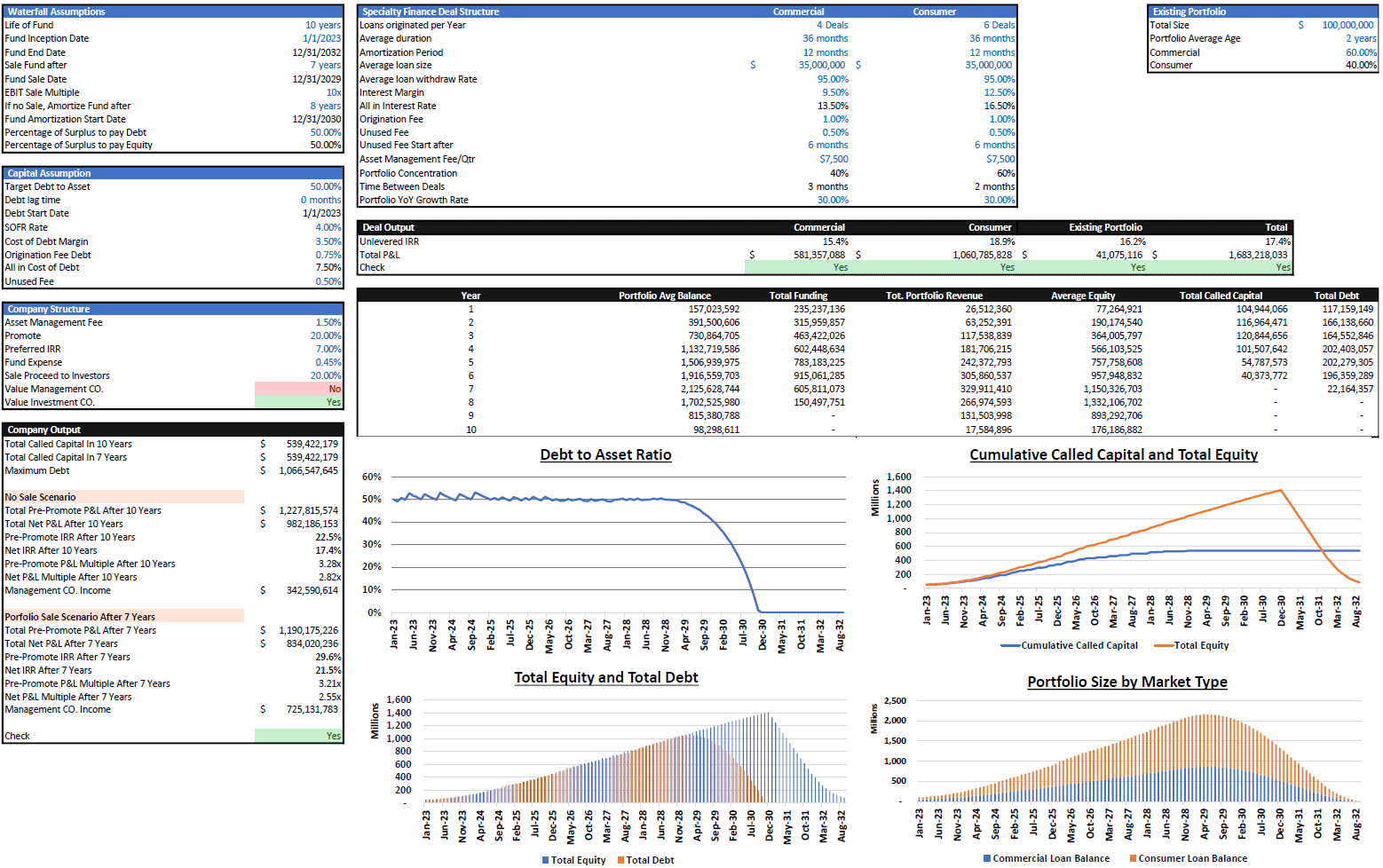

Our full-fledged financial model in excel format is a complete 10-year financial due diligence for an investment company, including private equity, asset management and advisory business lines. The model has the functionality to give different weights to the business lines to fit your business strategy. Our team of investment analysts customized the model from our vast archive of work with financial institutions. You can run your own assumptions for fund and asset under management sizes, pencil your management fees, structure your GP/LP details, input your custody and advisory fees, and spread your financials in terms of aggregate revenues, costs, asset schedules, cash flow, valuation, returns, in the greatest detail and scale-up as needed.

Alternative Investment Company Valuation: All-In-One Model for Private Equity, Asset Management, and Advisory Business Lines

1. OVERVIEW:

Our full-fledged financial model in excel format is customized for investment companies being set up or scaled, with unlimited combinations of fund structures and sizes within private equity, asset management, and advisory.

It is built on the back of our vast experience with financial institutions across a wide range of asset classes.

For a one-time charge of $2,250 and our free support after purchase, the study accounts for:

– A new fund or scaling up & restructuring an existing set-up

– Flexibility to run infinite fund sizes and structures

– All asset classes, namely private equity, asset management, and advisory

– Easy-to-use model due to straight-forward formulas & financial sheets

– Highest standards in financial modeling to ensure an accurate study

– A conservative base case scenario as a starting point for users

2. THE MODEL STRUCTURE

– “INPUT” sheets: We included a breakdown of funds along with their different metrics. For private equity, we included fund size, management fees, GP/LP distribution, hurdle rates, performance fees, advisory fees, among others. For asset management, we included AuM size, custody fees, advisory fees, management fees, performance fees, advisory fees, among others. In addition, a detailed breakdown and spreading of human capital, costs, assets/liabilities, cash flows, valuation items permit running optimal combinations to target the desired IRRs for fundraising purposes with LPs and management returns for GPs.

– “FINANCIAL STATEMENT” sheets are: Income statement, Balance sheet, and Cash flow statement are all a function of the “Input” sheets.

– “VALUATION” sheets are: Valuation sheet and Ratios sheet are a function of the “Input” sheets and showcase the financial performance of the fund(s).

3 THE FUNCTIONALITIES:

a. REVENUES:

– The assumptions cater to a wide mix of fund income enablers.

– The breakdown is split among fund size, fees, volume of investors/clients, profit sharing.

– Growth rates are changeable for fund sizes and fee levels.

c. COSTS:

– The model accounts for operating and capital costs.

– Operating costs are highly detailed, the user can add/delete/edit the needed ones, including salaries/bonus/carry and other costs.

– Capital expenditures (including depreciation) determine the asset purchases and changeable by the user.

d. RETURNS:

– IRRs, LP returns, GP returns for private equity; IRRs, client returns, management returns for asset management

– DCF valuation for the fund(s) and other financials are detailed such as balance sheet, income statement, cash flow statement.

You will get two files:

- Excel Model = .xlsm

- Macro Documentation = .docx

Similar Products

Other customers were also interested in...

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Fintech Financial Models Bundle

Financial technology (better known as fintech) is used to describe new technology that seeks to impr... Read more

Hedge Fund Soft Fee Model

A model that calculates hedge fund fees based on performance of the account over time. Includes a hi... Read more

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections and the insight they can provide... Read more

Legal Services Financial Model Excel Template

Buy Legal Services Financial Plan. Based on years of experience at an affordable price. Generates 5-... Read more

Mortgage Bank Financial Model Excel Template

Mortgage Bank Budget Template Create fully-integrated financial projection for 5 years With 3 way fi... Read more

Offshore Bank Financial Model Excel Template

Offshore Bank Financial Model Enhance your pitches and impress potential investors with the expected... Read more

Private Equity Fund Model (Investor Cashflows)

Private Equity Financial Model to analyze fund cashflows and returns available to Limited Partners (... Read more

Banking Model with 3 Statements – Dividend D...

Banking Model with 3 Statements - Dividend Discount (DDM) and Net Asset Value (NAV) based Valuation ... Read more

Reviews

You must log in to submit a review.